The retail banking industry in South Africa is transforming at an unprecedented pace. Traditional banks, digital-first challengers, and fintech platforms are all competing for the same customer, one whose expectations are shifting faster than ever.

Branch expansions may keep pace with population growth, but customer acquisition is increasingly digital. While banks invest heavily in AI, cloud, and cybersecurity, their cost-to-income ratios remain high. South African banks, for example, report a staggering 52.9% ratio. This indicates how customers today are more empowered, more informed, and less forgiving.

Winning in this climate requires a brand to be more relevant than present.

In view of this shifting retail banking landscape, Borderless Access recently conducted a study in March 2025 across nearly 400 South African banking customers. Using its proprietary brand tracking tool, BrandKompass™ the study aims to help banks understand not just who their customers are, but how deeply they are connected to their brand.

- BrandKompass™: Redefining How Loyalty is Measured

- Trust is the New Currency in Retail Banking

- Operational Excellence Is Now Brand Capital

- From Indifference to Advocacy: Closing the Loyalty Gaps

- Media and Messaging: Success Lies in Precision, Not Volume

- Final Word: Loyalty Is the Key Driver of Business Growth

- Why BrandKompass™ Matters for Decision Makers in Retail Banking

BrandKompass™: Redefining How Loyalty is Measured

At the heart of this study is Borderless Access’ proprietary tool—BrandKompass™. Unlike conventional brand tracking solutions that focus on awareness or usage, BrandKompass™ measures brand affinity: the depth of relationship customers have with their bank.

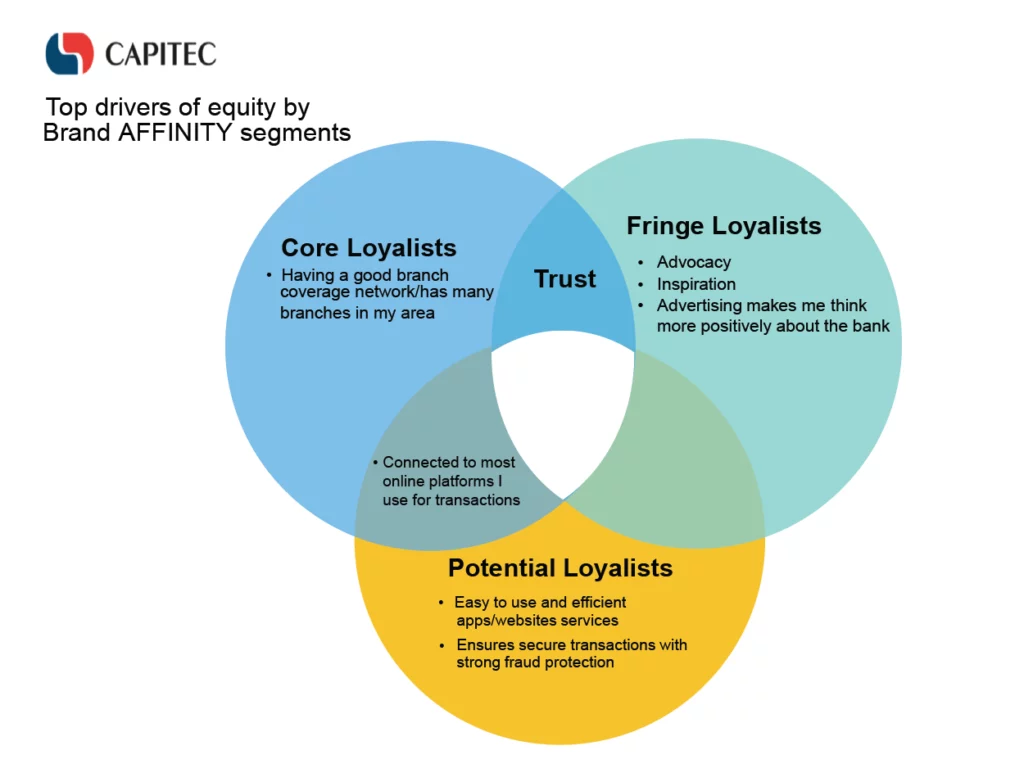

Through this lens, consumers are segmented into:

- Core Loyalists – Emotionally committed customers who form the foundation of growth.

- Fringe Loyalists – Functionally engaged but emotionally shallow; vulnerable to switching.

- Potential Loyalists – Non-users with positive perceptions, ripe for conversion.

- Open/Unavailable/Unaware – Segments harder to convert or loyal elsewhere.

The ultimate goal? To help banks maximize the size of their Core Loyalists while strategically engaging fringe and potential groups.

Trust is the New Currency in Retail Banking

The research uncovers a powerful insight: trust is the currency that unites all segments. But how that trust translates into growth differs across groups:

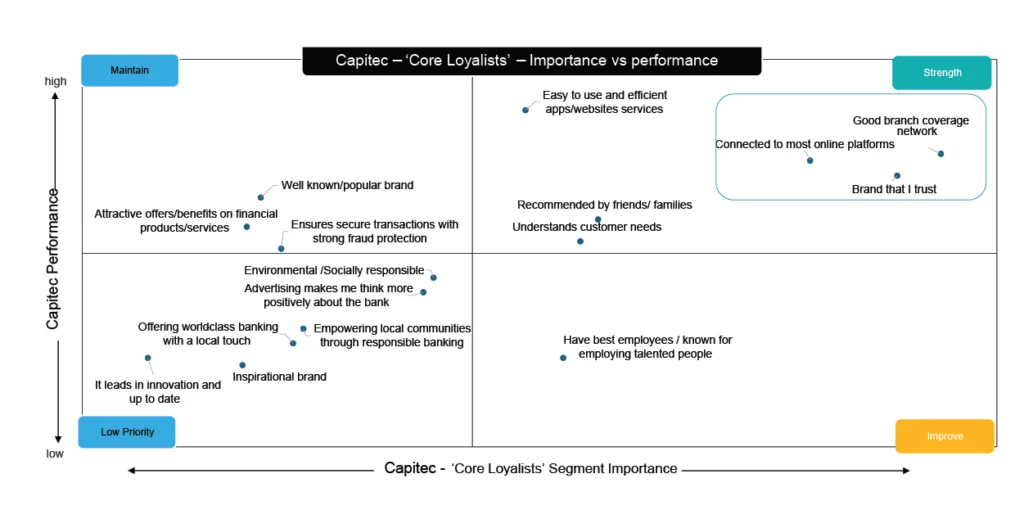

- Core Loyalists value strong branch coverage, reliable employees, and brands that understand their needs.

- Fringe Loyalists respond to advocacy, inspirational branding, and positive storytelling.

- Potential Loyalists are looking for seamless onboarding, digital ease, and visible value alignment.

This shows that loyalty is not linear but layered. It cannot be bought through advertising alone—it must be earned through relevance and resonance.

Operational Excellence Is Now Brand Capital

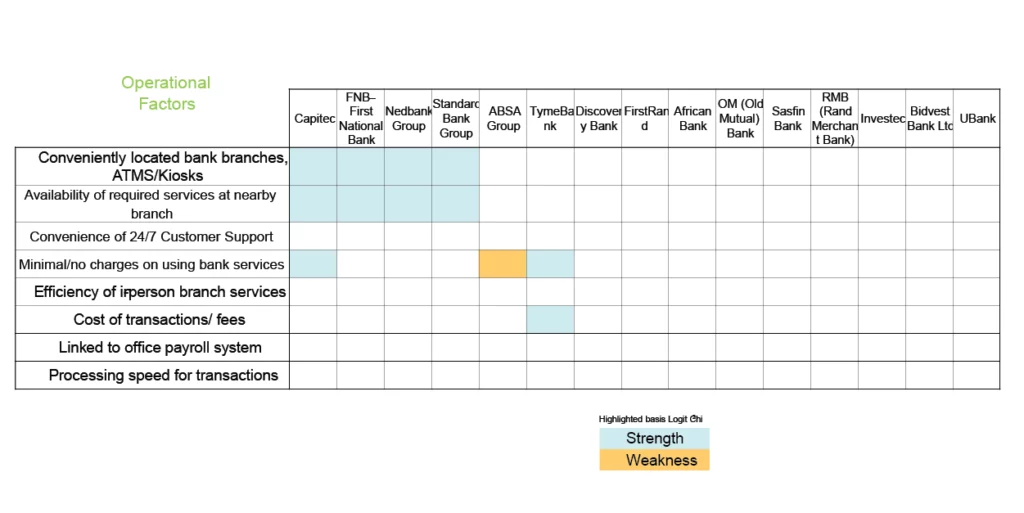

One of the clearest takeaways from the study: operational factors are no longer back-office concerns—they are brand differentiators.

Customers consistently reward banks that deliver:

- Ease of access and convenient branch coverage

- Low service fees

- Fast, visible transaction processing

Capitec’s market dominance is a case in point. Its success stems not only from strong brand equity but also from consistent operational delivery. By contrast, other banks with similar equity scores fail to capitalize because their service execution does not match their promises.

The message is clear: if your infrastructure lags, your brand equity is at risk.

From Indifference to Advocacy: Closing the Loyalty Gaps

The segmentation analysis also reveals where banks are leaking loyalty—and where opportunities lie:

- Capitec enjoys a strong core base but must fortify advocacy among fringe users.

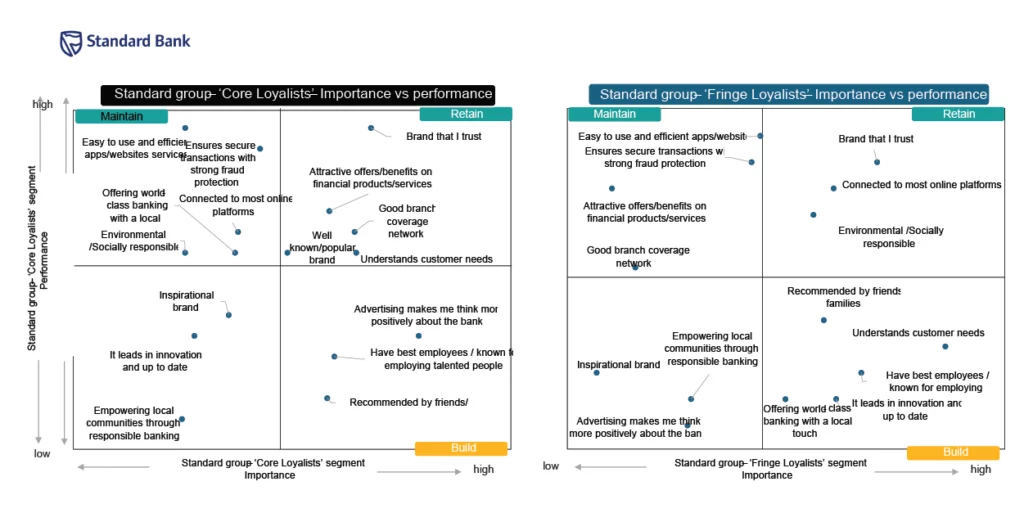

- Standard Bank must improve its ability to understand customer needs and invest in employee experience to move fringe users into the core.

- Other incumbents face the challenge of converting awareness into meaningful top-of-mind recall, especially among younger segments.

Across the board, one insight stands out: indifference is the true competitor. Customers may trust their bank, but without emotional connection, they won’t recommend it—or stick with it.

Media and Messaging: Success Lies in Precision, Not Volume

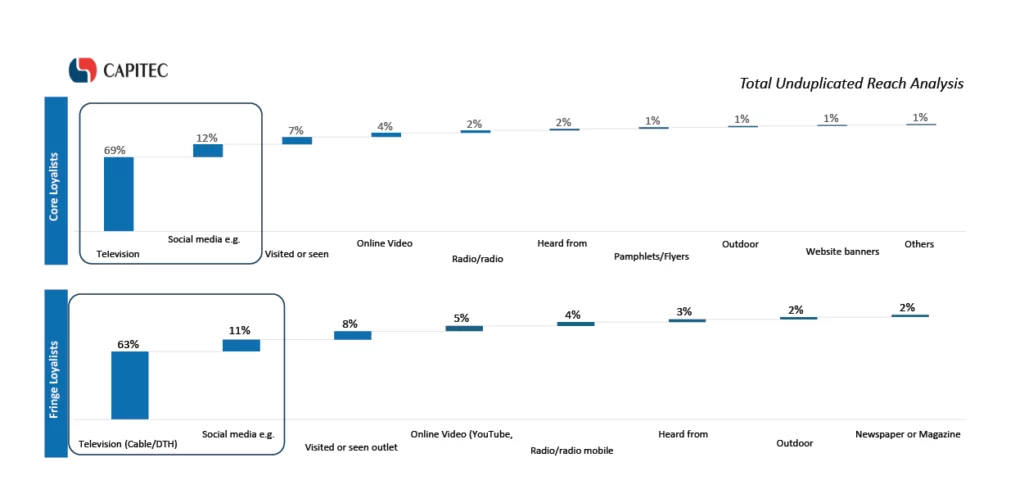

The study also examines how to reach each loyalty group most effectively:

- Core Loyalists: Inspire and reward through personalized campaigns, loyalty platforms, and success stories.

- Fringe Loyalists: Emphasize digital convenience, environmental/social responsibility, and advocacy via social media and traditional TV.

- Potential Loyalists: Lean into mobile-first engagement, seamless onboarding, and influencer-driven credibility.

This precision-led approach is exactly what BrandKompass™ enables: aligning message, product, and channel to customer affinity.

Final Word: Loyalty Is the Key Driver of Business Growth

In a crowded, fast-evolving retail banking market, the most defensible advantage is not technology or pricing—it is loyalty.

But loyalty isn’t accidental. It’s the result of trust earned, needs understood, and experiences delivered with precision. Borderless Access’ BrandKompass™ study shows that with the right framework, banks can move customers from functional engagement to emotional commitment—transforming indifference into advocacy.

The real question for decision makers is this: Do you know how many of your customers are truly loyal—and how to grow that number?

Why BrandKompass™ Matters for Decision Makers in Retail Banking

For CXOs, CMOs, and business strategists, the implications are clear:

- You cannot manage what you cannot measure. BrandKompass™ provides the granularity to see exactly where your loyalty pipeline is strong or leaking.

- Emotional connection is measurable. Understanding affinity allows banks to move beyond awareness metrics to actionable strategies.

- Operational and brand equity must align. Disjointed delivery erodes trust, while consistent execution strengthens it.

BrandKompass™ is not just a tracker—it’s brand diagnostic tool helping brands to drive steady growth. It is designed to transform data into direction and brand affinity into business outcomes.

Curious to know how BrandKompass™ can help you identify the most convertible customer segments, strengthen trust where it matters, and build loyalty that lasts?