Globally, marketing spend is focussed predominantly on digital media – specifically social media. However, consumer exposure and trust indicate that the traditional channels still hold relevance. So, on which channels should marketers be focusing?

Use of and exposure to media channels has naturally been but one of the aspects affected by recent global shifts due to the Covid-19 pandemic. Borderless Access surveyed both consumers and marketing professionals across 11 countries to understand how these shifts have changed the industry – and what they mean for the future of media and marketing.

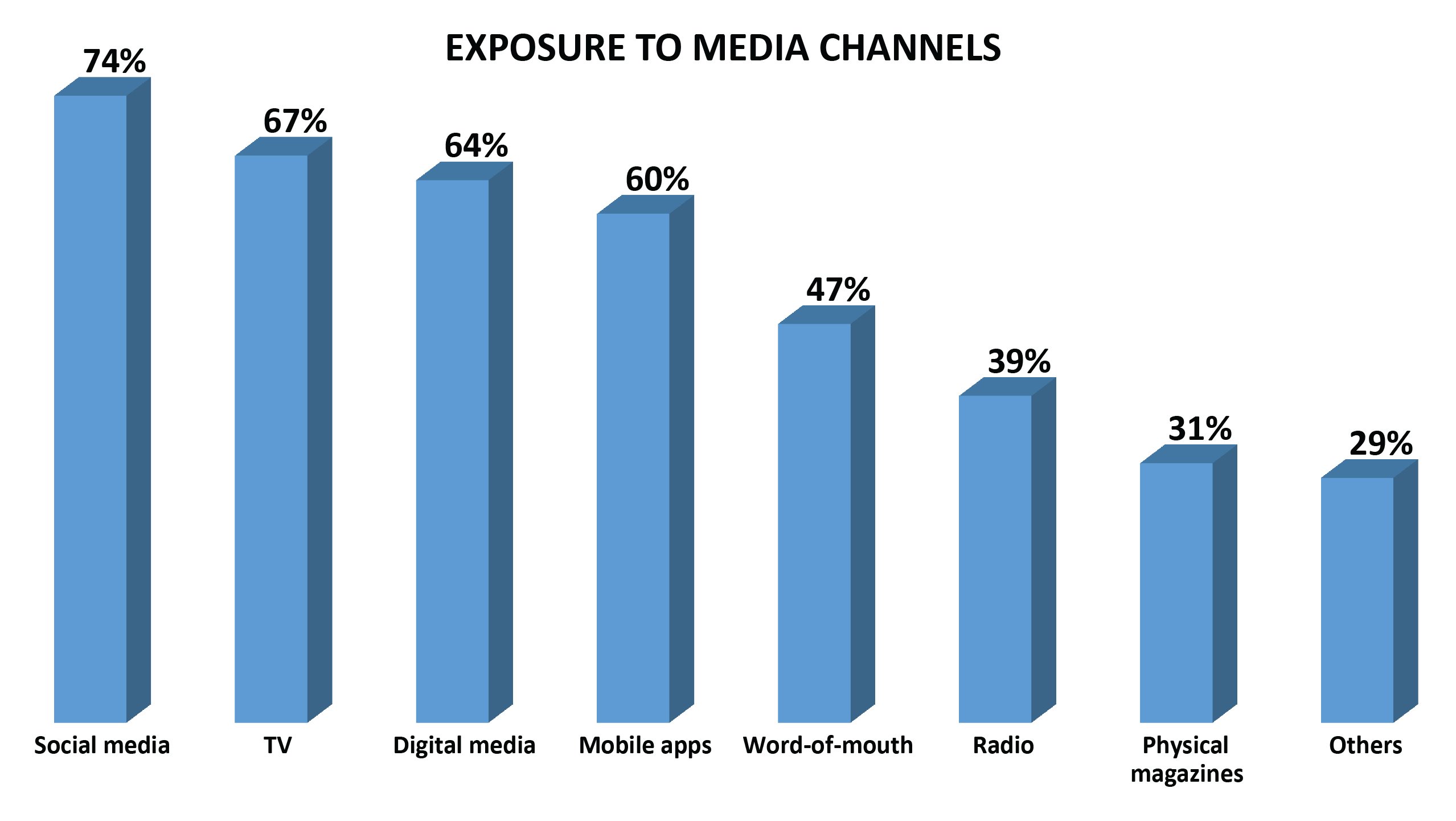

Social media is definitely the channel that consumers feel they have the greatest exposure to, with three-quarters of people globally using this media channel. Presumably due to the ongoing worldwide lockdowns, word-of-mouth currently has much lower exposure than this digital counterpart.

- Traditional channels still elicit the most trust

- Marketing spend has a strong digital focus

- Usage of social media is driven by marketing

- TV receives minimal marketing investment

- Social media triggers the highest likelihood to purchase

- Marketers focus their attention on digital channels

- Digital focus is important but don’t lose sight of traditional channels

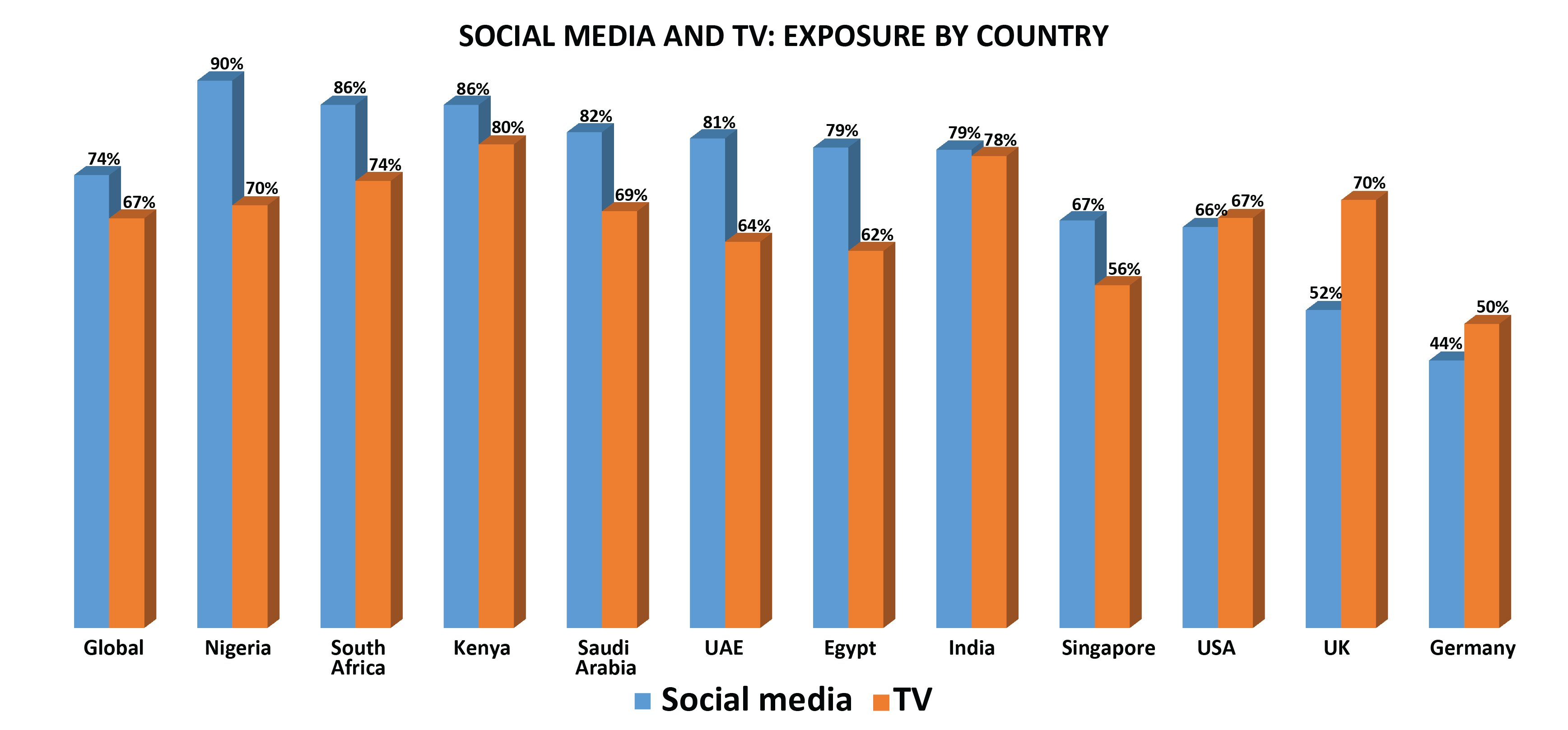

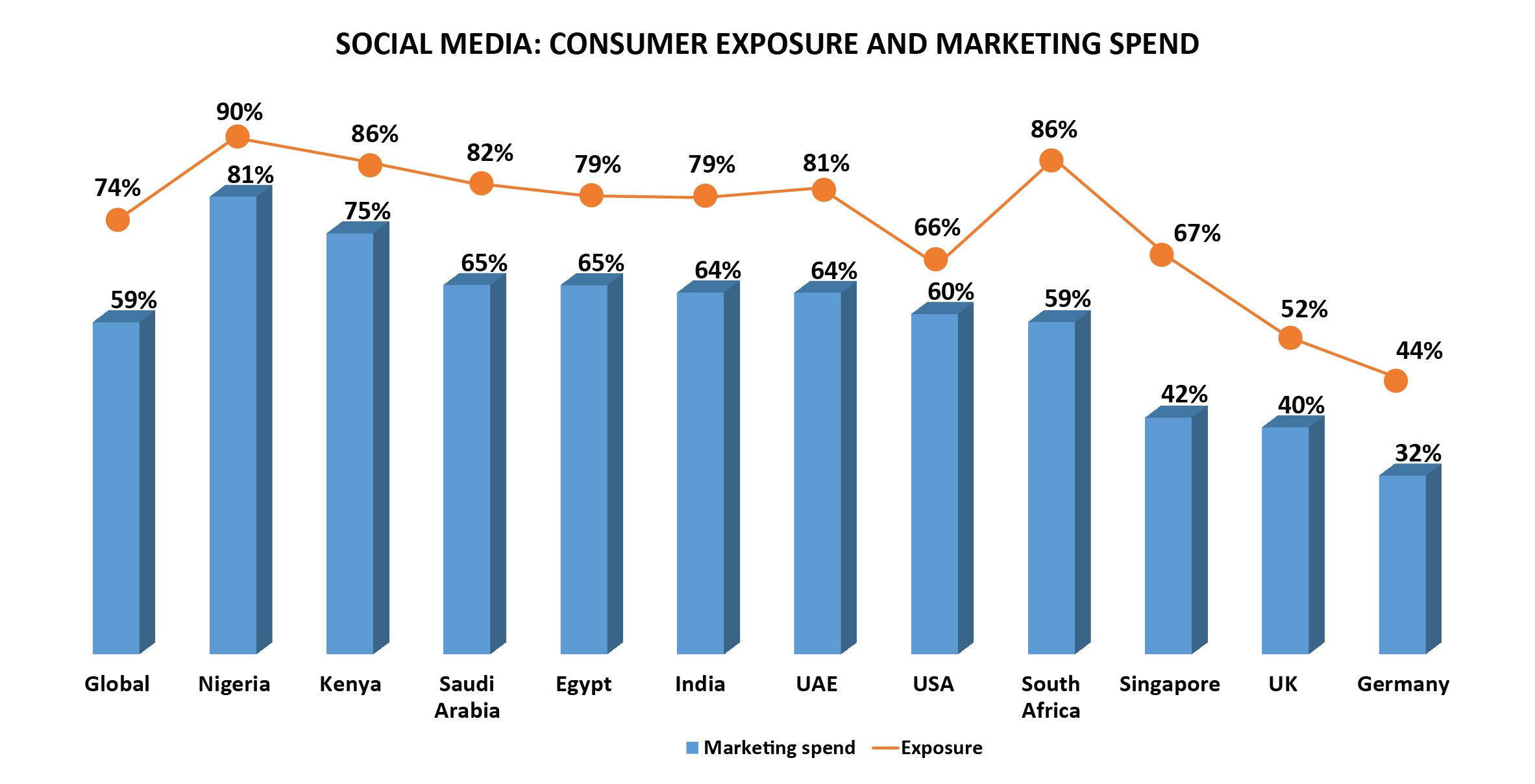

Social media reliance differs by country’ or something of that nature

Of the countries that took part in this online study, the sub-Saharan African countries are by far the most exposed to social media, reinforcing the finding that Africa is fast catching up (and, in some cases, even surpassing) the rest of the world in terms of its online exposure.

TV is still the second most popular channel globally, this driven by many countries but, in particular, Kenya and India.

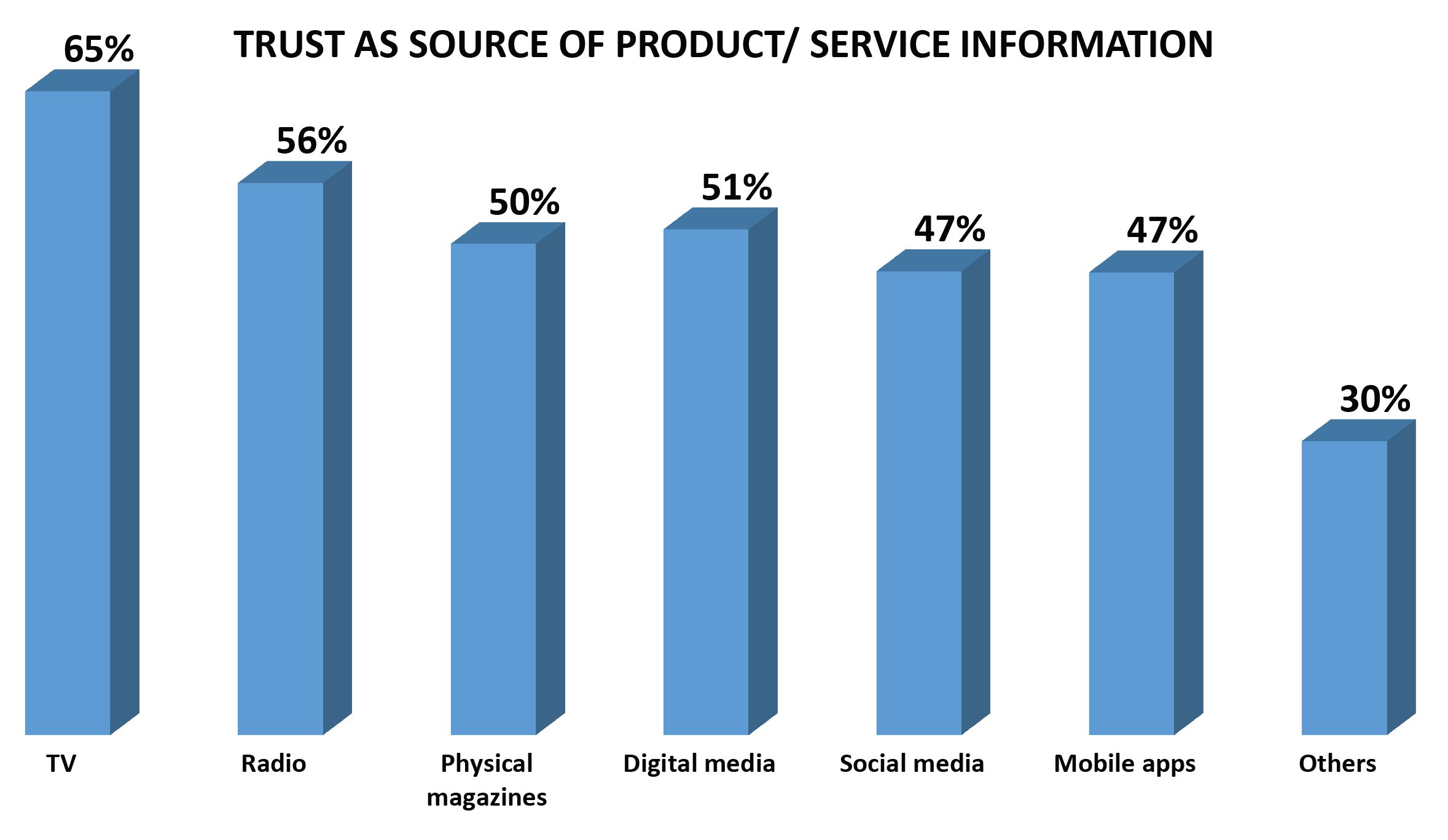

Traditional channels still elicit the most trust

When it comes to trust in the media, however, we see a different picture. In spite of its prevalence and exposure, only half of these consumers trust social media as a reliable source of product or service information, with the traditional channels of TV and radio sitting comfortably in top positions.

From a consumer perspective, we, therefore, see that people worldwide are the most exposed to social media but still have more trust in TV than any other channel when it comes to product and service information.

How does this stack up against where the marketing and media professionals are focussing their attention?

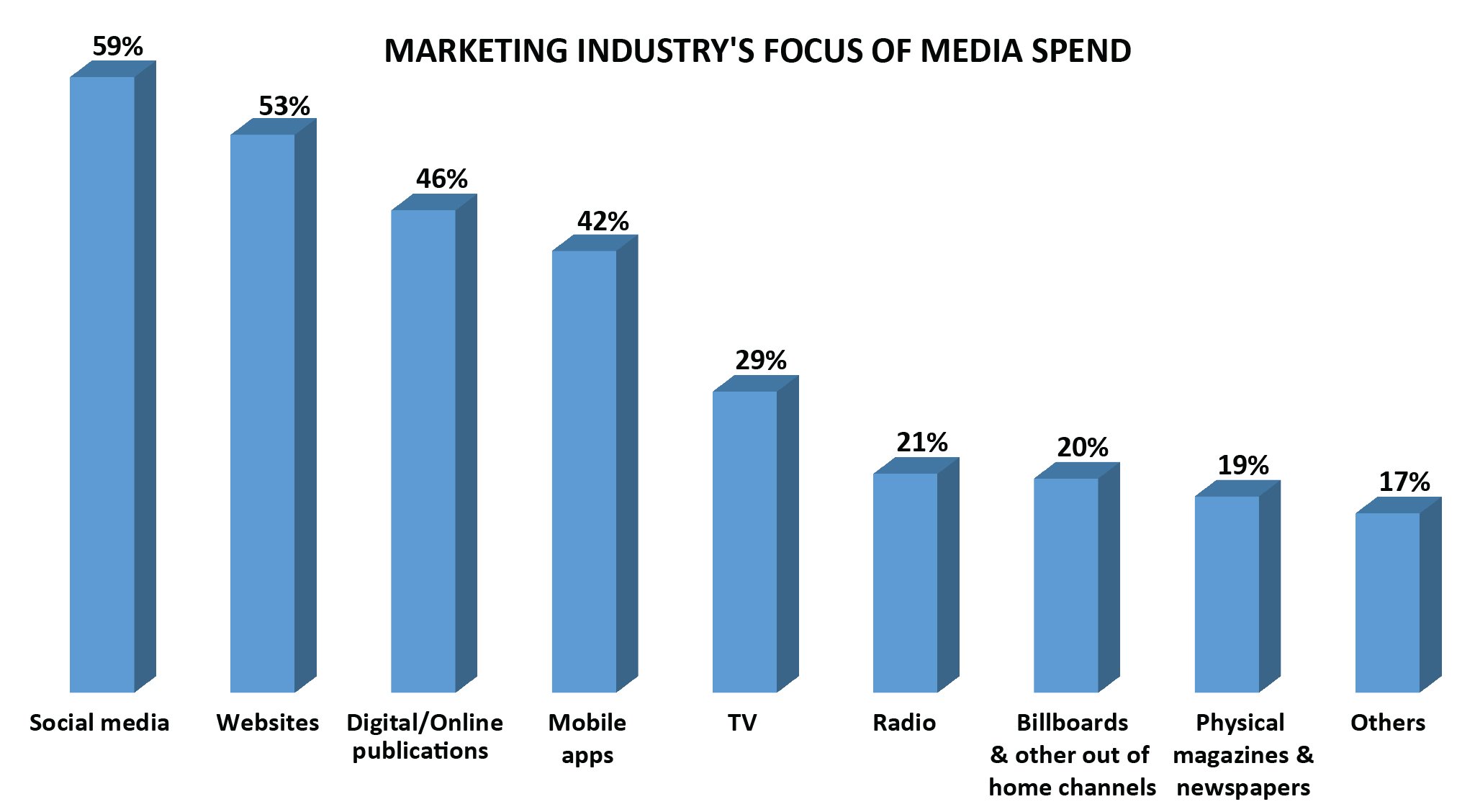

Marketing spend has a strong digital focus

Not surprisingly, we see that markets are focusing heavily on the social media space – a trend that had already started pre-Covid-19 and has been further boosted during this time. Other digital channels (websites, digital publications and mobile apps) are also receiving a fair amount of attention, with the traditional channels certainly being ‘left behind’ in terms of marketing spend.

Usage of social media is driven by marketing

As we have seen, the sub-Saharan African countries lead the way in terms of exposure to social media as a channel. It is clear to understand why, when we overlay this finding next to marketing spend, the majority of countries in the sub-Saharan region and the Middle East region are pushing focus on this channel, with exposure closely following suit.

Singapore, the UK and Germany show a very different trend, with little marketing focus on this channel, resulting in lower consumer exposure to it. The UK devotes a large proportion of its spend to TV whereas German interestingly still focuses on print channels more than some other countries. Singapore does not purport to focus its marketing spend on any one channel predominantly.

In all cases, it is clear that marketing spend is directly affecting consumer awareness of and exposure to the channel.

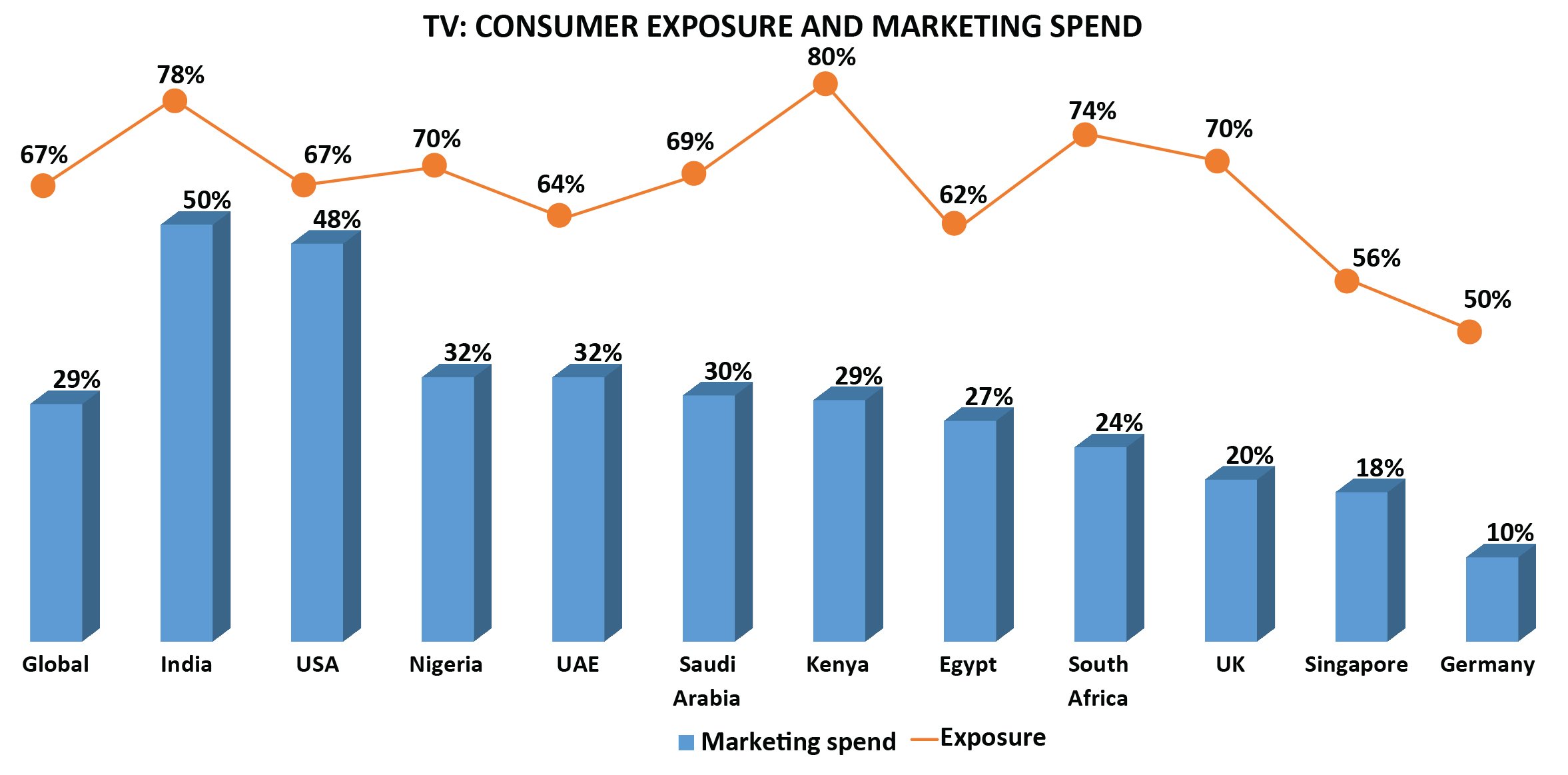

TV receives minimal marketing investment

Overlaying the same information for TV, we see a different picture. Firstly, it becomes abundantly apparent that all countries are spending and focussing less on TV than its exposure warrants. This implies that the traction that TV holds in the consumer’s mind is due to its historical standing.

Of the surveyed countries, the only two to focus a high percentage of their marketing spend on TV are India and the USA: In India, this spend is resulting in high exposure, whereas the high exposure is not directly linked to spend.

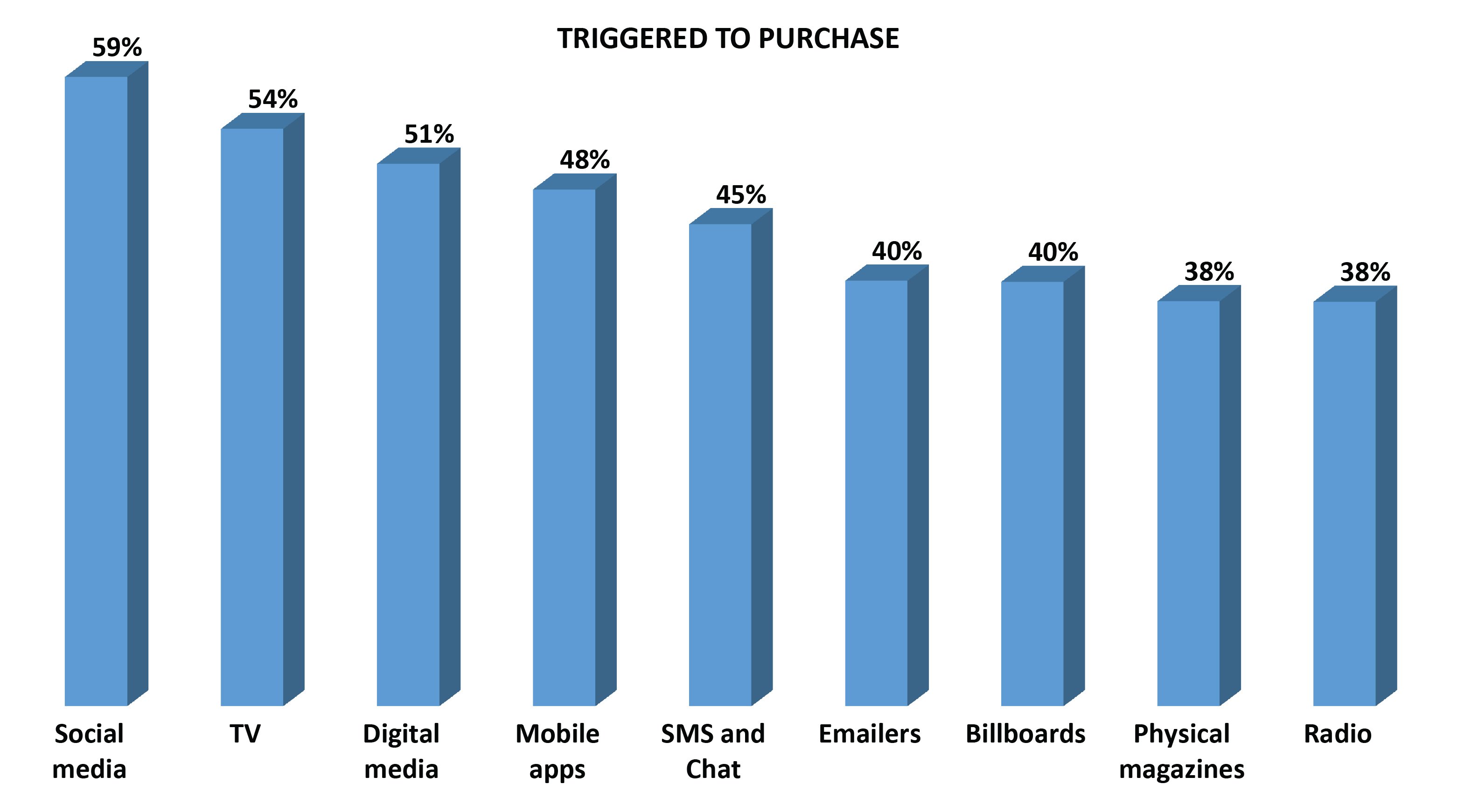

Social media triggers the highest likelihood to purchase

The high levels of trust in traditional channels as a source of product/service information are evidently important drivers of decisions around where to focus marketing spend. However, they are not the only factor. Of course, the likelihood of communication on different channels to actually trigger purchase, is a huge factor too.

Here is where social media does indeed currently surpass TV, holding the greatest likelihood of all the channels to result in purchase of the products or services communicated.

Marketers focus their attention on digital channels

It is clear that social media has become a major factor in the eyes of both marketers and consumers, as a way to effectively communicate product or service information. As the channel with the highest likelihood to trigger purchase, it is evident why this is the case.

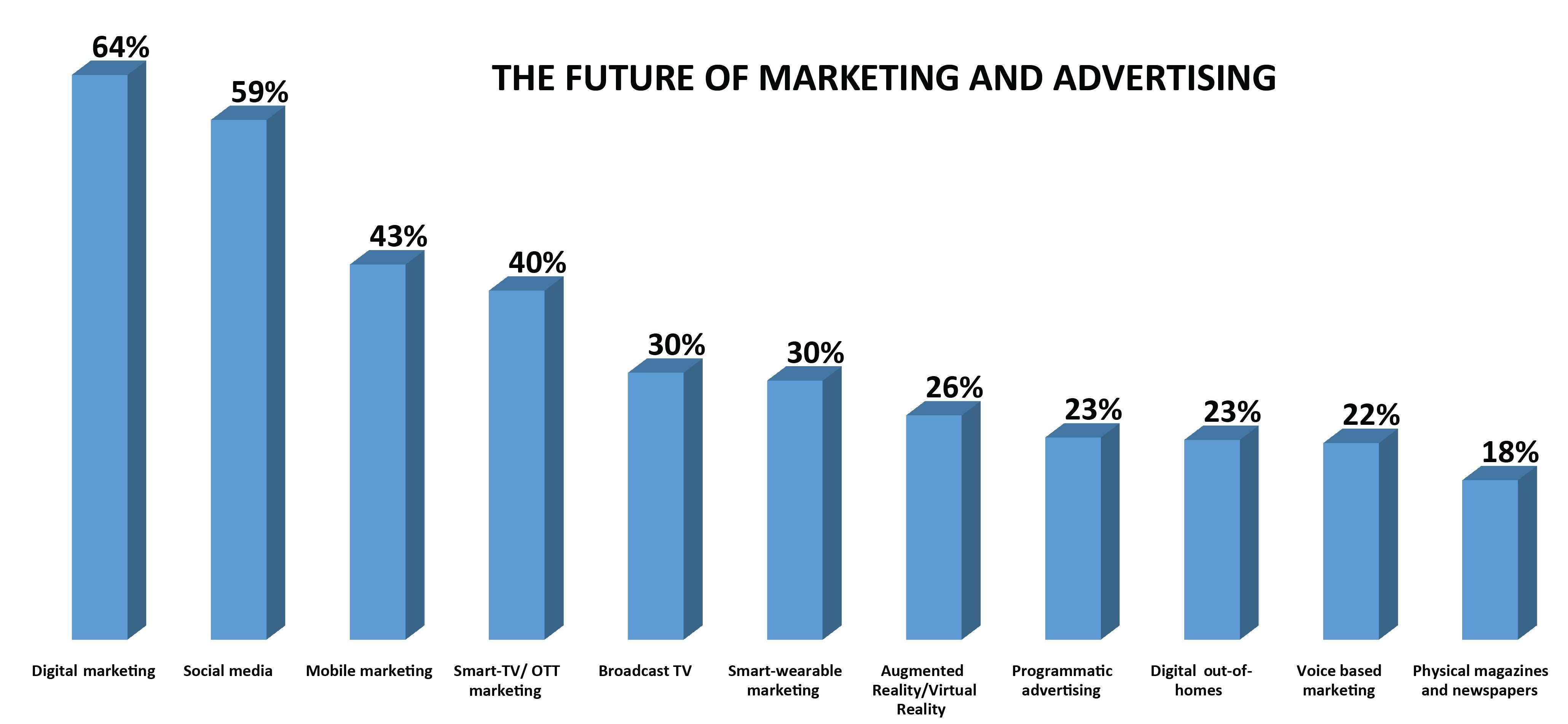

Marketers feel that the future of the industry lies firmly within the digital space, with broadcast TV only holding fifth position in its interest levels.

Newer channels such as augmented reality, smart-wearable reality and programmatic advertising are all features that hold interest in the minds of marketers, yet haven’t risen to the fore as much as other better-known digital channels.

Digital focus is important but don’t lose sight of traditional channels

It is indisputable that digital channels are the current focus of both marketers and consumers – and that they continue to grow.

However, traditional channels – led by TV – still hold a great deal of trust in the minds of the consumer, and also hold the ability to trigger a purchase. The low focus of marketing spend on these channels has the potential to eradicate them in time, if continued.

Marketers would therefore be cautioned to retain a balanced approach between digital and traditional marketing channels, as the world re-establishes its new normal.

Borderless Access provides access to its first-party hyper-niche digital audiences across consumer and B2B panels, amongst others.