The insights industry has been struggling with a persistent challenge for quite some time—survey fatigue. Triggered by various factors like cognitively heavy questions, poor survey designing, or outdated incentive models, survey fatigue has become a widespread concern among insights and research professionals. It is especially prevalent among hard-to-reach audiences that include highly specialized professionals (mid-market business buyers, and decision makers), niche demographic segments, or populations with limited availability.

Due to their exclusivity and high strategic value, these audiences don’t respond well to generic customer research surveys. The disengagement leads to a sharp rise in mid survey drop offs, and for research teams, it means over-stretched timelines, inconsistent data quality, and entire studies hanging on the participation of a few reluctant voices.

To reduce these drop-offs and maximize the value of each respondent, researchers need to treat panelists as experts and build engagement models that reflect their expectations. Optimizing the survey experience is the only way to keep providing high quality insights that contribute to meaningful business outcomes.

Why Hard to Reach Audiences Demand a New Approach

Niche audiences are no longer motivated by broad recruitment drives, generic incentives, or static quota systems as they are often over-surveyed and are short on time. When a customer research survey feels irrelevant or misaligned with their expertise, they either drop out early or rush through answers, which weakens the dataset and raises the cost of collecting reliable insights.

Research shows that repeated outreach and poorly targeted invitations drive fatigue and faster disengagement.

These audiences expect a very different experience. For specialists, recognition matters just as much as incentives. They want to feel their knowledge is understood and that the survey values their contribution. When surveys fail to create this sense of trust , the engagement rate falls and data quality declines too.

Hard to reach audiences therefore demand a new, performance driven approach: targeted recruitment, clearer value propositions, continuous respondent ranking, and a frictionless survey experience. When done right, this reduces drop offs and strengthens the strategic value of every insight delivered to clients.

How Borderless Access Is Boosting Response Rates in Customer Research Surveys

As the motivations of respondents in consumer research surveys continue to evolve with time, research teams must better try to understand why people engage, when they are most responsive and what keeps them coming back.

This is exactly where Borderless Access is raising the bar.

Borderless Access is boosting engagement and response rates by using historical data, automated quality checks and predictive modelling to pinpoint exactly what drives respondent participation.

Our analysis shows that panelists who join through open registration, maintain richer profiles or approach reward redemption are far more likely to respond consistently. We use these patterns to keep high-intent panelists active through timely incentives, tailored communication and faster recognition of their contribution.

At the same time, hypothesis driven analytics highlight behavioural signals—such as using multiple devices or returning after incomplete surveys—that help us predict who will stay engaged.

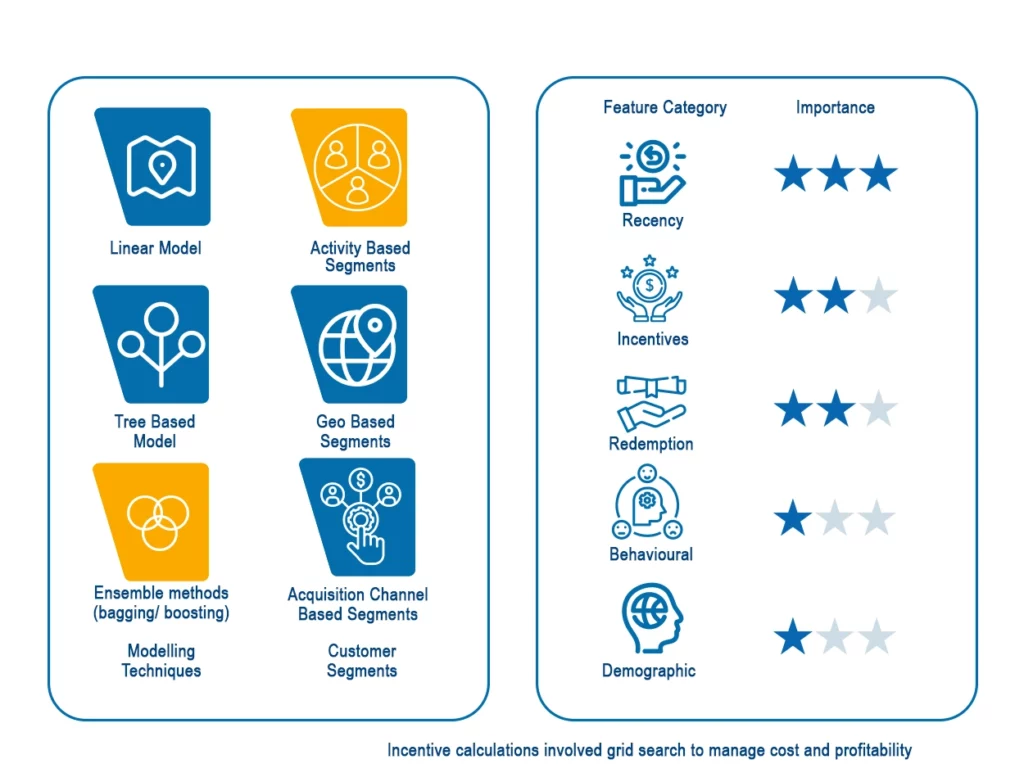

The Borderless Access team also combines machine learning models with customer segment insights like recency, incentives and behavioural cues to create a dynamic respondent ecosystem where motivated, reliable individuals rise to the top.

When panelists are recruited with care and kept genuinely engaged, businesses see three major gains: more reliable data, higher participation, and stronger trust in the insights they receive.

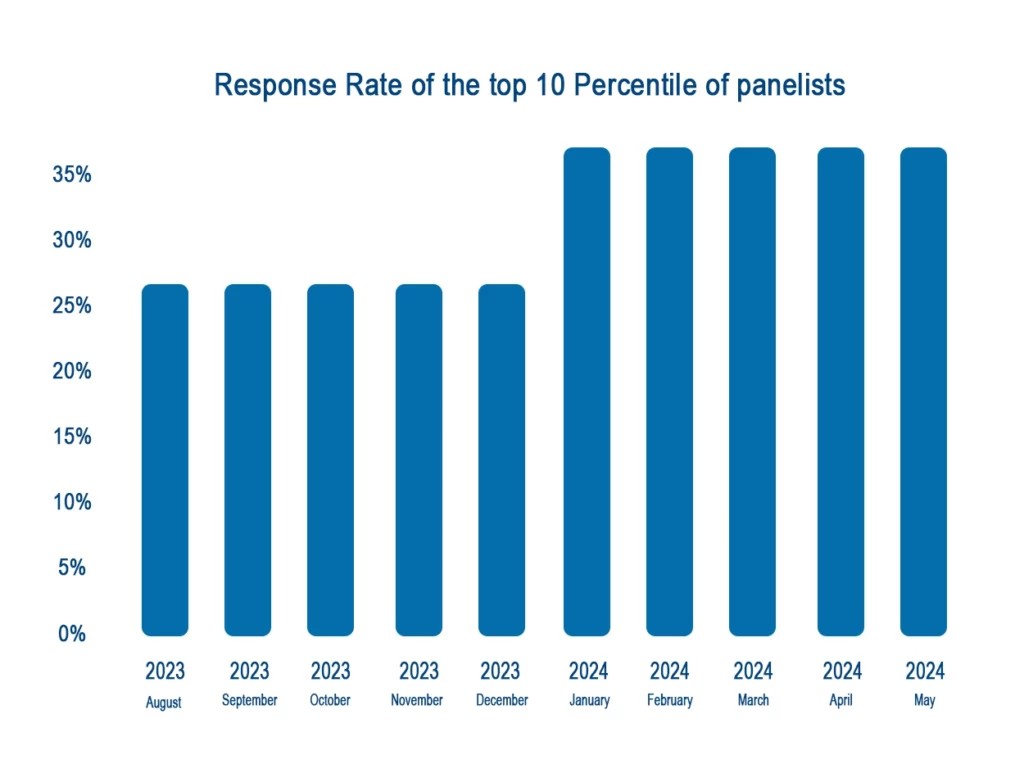

We recently witnessed this firsthand when our top panelists showed a significant jump in response rates after we strengthened our quality controls. This shift highlighted three clear benefits.

- Better Identification of the Right Respondents

Because our system now focuses more precisely on authentic, committed panelists, we are reaching people who are both willing and eager to participate. This has made our respondent pool for online panel surveys more reliable and more responsive.

- Faster Data Collection

Higher response rates from our best panelists mean studies move quicker. We collect data faster, shorten project timelines, and deliver insights to clients sooner, increasing the overall value of our services.

- Higher Revenue Through Larger Sample Allocations

As clients see the strength and consistency of our improved consumer survey panel, they feel more confident assigning larger sample sizes. This trust in data quality translates directly into better business outcomes and healthier project pipelines.

Every Life in Respondent Engagement Adds a Value

Every small increase in respondent engagement has a multiplying effect on the quality of insights. When more respondents stay through to the end, the data becomes richer, patterns become clearer and segmentation becomes more meaningful, leading to more informed business decisions.

Improved engagement also cuts hidden operational costs. Teams spend less time re fielding studies, less budget over sampling to fill gaps and far fewer hours cleaning inconsistent data. This efficiency frees researchers to focus on higher value analysis instead of recovering from avoidable quality issues.

At Borderless Access, we believe in providing high quality experiences in customer research surveys to ensure the insights gathered from our panels are reliable and always actionable.