Online surveys have propelled business decisions, policy frameworks, marketing strategies, and academic research for quite some time now. They’re fast, cost-effective, and scalable. But this convenience has come at a cost: survey fraud is rising, and it’s quietly eroding the reliability of insights that drive multi-million-dollar decisions.

A leading U.S. consumer goods company paid a heavy price, investing nearly $1.5 million to expand into Latin America after a survey suggested ‘strong interest’ among survey respondents. Later, they discovered that over a quarter of the responses from their online panels were fake and many were completed by non-native speakers using translation bots to qualify for the study.

This is what happens when fake or uninterested respondents fill in a survey. The data stops reflecting reality. It sets off a chain reaction of bad decisions, with insights becoming misleading because they no longer represent real customer needs.

As fraud increases, so does skepticism. When decision-makers start doubting the validity of consumer insights, they lose confidence in insights teams, market signals, and consumer feedback. Some even shift investment away from customer understanding.

To battle this mistrust, market research and insights companies are scrambling to find ways to mitigate survey fraud and protect research integrity at any cost.

Frauds are Now Smarter, Faster, and Harder to Detect

The digital shift in market research opened doors to mass participation, but also to mass manipulation at the same time. Fraud in surveys no longer means just ‘lazy respondents.’ Instead, it often involves bots, click farms, and professional survey-takers who exploit incentives and loopholes in panel systems.

AI-powered bots can now mimic human behavior by varying typing speed, using natural-sounding language, and even changing IP addresses through VPNs or proxies. Click farms (groups of low-paid workers, often offshore) complete thousands of surveys daily, feeding platforms with low-quality or fake data for incentives. Fraudsters also use identity spoofing to bypass geographic or demographic restrictions like pretending to be a U.S. respondent to qualify for a high-paying study.

A recent study by the Market Research Society (MRS) found that up to 30% of responses in online panels showed signs of automation or duplication. In another case, fraud compromised an entire concept test for a global brand because fake respondents distorted pricing preferences.

These instances are rare. They are becoming the norm, and businesses are paying for it. Bad data spreads into business decisions and creates costly mistakes. When the insights are wrong, teams end up building products nobody wants, targeting customer segments that don’t exist, or entering markets based on false demand signals.

Protecting Data Integrity in the Age of Sophisticated Fraud

Traditional fraud detection tools were built for a simpler time, when the biggest threats were careless respondents or repeated IPs. Today’s fraud landscape is far more complex. Bots behave like humans, click farms blend into traffic patterns, and identity spoofing makes it hard to tell who is actually taking your survey. Relying on old methods is no longer enough.

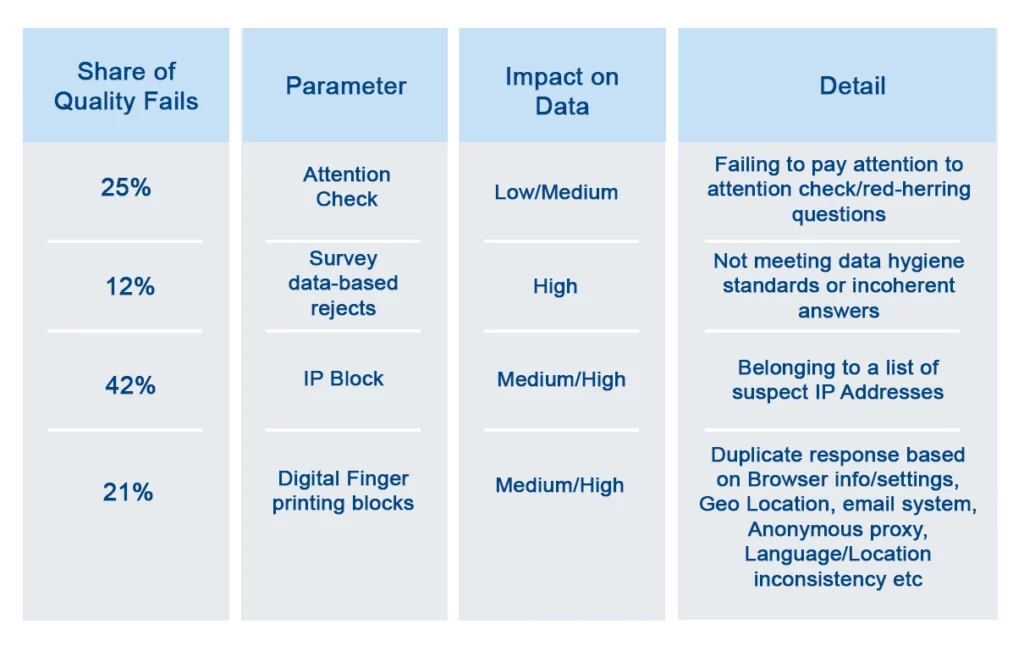

The data collected from our study shows that most quality issues in online panels happen because respondents fail attention checks, meaning they don’t read questions carefully, or their answers don’t meet basic quality standards. The biggest chunk of issues, however stem from blocked IP addresses linked to suspicious or repeat activity, or where the device details suggest the same person tried to take the survey multiple times.

To protect insight integrity, companies now need a multi-layered defense system that checks identity, behavior, intent, and quality at every step of the respondent journey. This is exactly why Borderless Access, as a leading survey panel provider, has built QMan™, our proprietary quality engine designed to ensure trustworthy data throughout the entire research lifecycle — from recruitment to post-survey engagement.

a) Respondent Recruitment

QMan™ begins with strict screening before a respondent is ever allowed into a study.

This includes:

- Digital fingerprinting to identify unique devices and prevent duplicates or bots.

- Geo-validation to confirm respondents are actually located where they claim.

- Triple opt-in verification to ensure real consent and filter out fake or low-intent participants.

This stage helps us capture real intent from real people, creating a clean, authentic pool even before the survey launches.

b) Survey Launch

Once the survey goes live, QMan™ activates dynamic, in-survey protection layers that keep bad data out and preserve the study’s integrity.

These include:

- Attention checks that identify respondents who aren’t reading or engaging.

- LOI (Length of Interview) monitoring that flags people who move too fast or too slow to be genuine.

- Smart sampling that detects unusual patterns and adjusts targeting accordingly.

- Duplication prevention that blocks multiple entries from the same person or device.

This ensures that only thoughtful, valid responses make it into the dataset — not bots, or fatigued participants.

c) Post-Survey Engagement

QMan™ doesn’t stop when the survey ends. After completion, the system evaluates respondents using:

- Machine learning–driven behavior prediction, spotting who is likely to remain reliable over time.

- Engagement scoring that measures honesty, consistency, completion patterns, and attention levels.

This helps us reward and retain only high-quality contributors, strengthening the panel with each cycle. Over time, low-quality respondents naturally phase out, while the trustworthy ones remain actively engaged.

Restoring Trust in Online Research Panels

As AI, automation, and incentive-driven fraud continue to evolve, survey quality faces unprecedented threats. But with the right safeguards grounded in technology, analytics, and a rigorous validation process, research can stay reliable and decision ready.

At Borderless Access, we believe protecting data quality in online market research panels is not just a responsibility. It is the foundation of every strategic decision our clients make.

If you want to strengthen your research quality and ensure fraud-free surveys, connect with our experts at Borderless Access to learn how we can help.