The UK retail banking market is entering a new era. Valued at £68.77 billion in 2025 and projected to grow steadily through 2033, the industry is no longer defined by size or legacy.

A new study by Borderless Access, powered by its proprietary brand tracking tool BrandKompass™, reveals how consumer trust, brand relevance, and experience are reshaping the competitive landscape.

For CXOs and senior decision-makers, the findings point to one truth: growth now depends on loyalty, not just awareness.

Consumers Are Rewriting the Rules

The UK retail banking market has transformed over the last decade. Several forces are converging:

- AI-powered personalization is redefining what “service” means.

- Open banking and embedded finance are reshaping where banking happens.

- Green finance and ESG have shifted from optional to mandatory.

- Regulation, particularly the FCA’s Consumer Duty, demands not just service delivery but positive consumer outcomes.

Amid cost-of-living pressures, interest rate swings, and geopolitical uncertainty, customers are becoming more selective. They don’t just want banks to be functional; they want them to be secure, human, and purpose-driven.

This evolution has profound implications: trust is no longer enough. Emotional connection is now the moat that protects growth.

Beyond Usage: Measuring Brand Loyalty

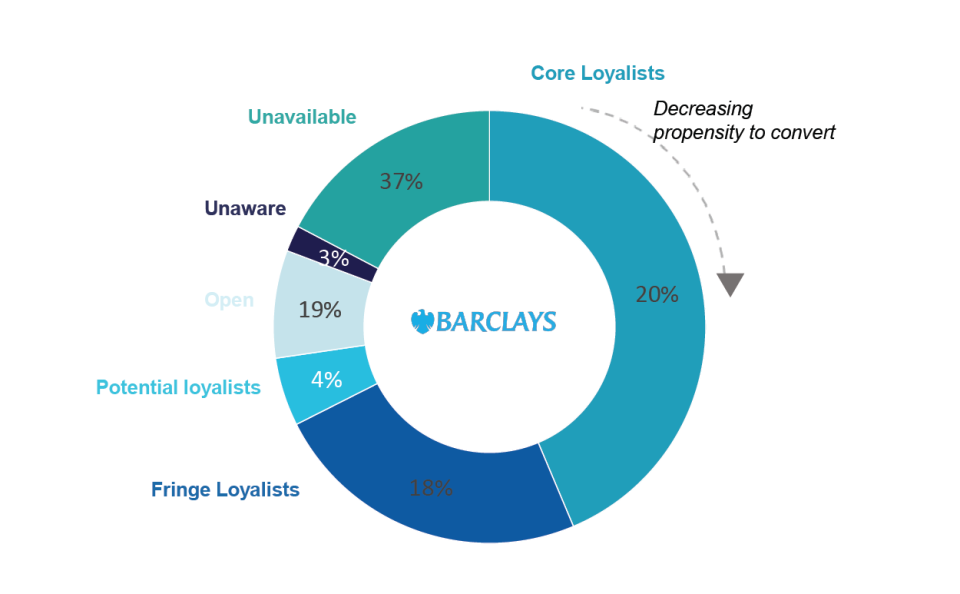

Borderless Access’ proprietary brand tracking tool BrandKompass™ segments consumers into Core Loyalists, Fringe Loyalists, Potential Loyalists, and the unaligned majority. This segmentation goes beyond traditional brand equity tracking metrics, exposing how people feel about their banking relationships.

Take Barclays as a case in point:

- Core Loyalists (20%): Emotionally committed, forming the foundation of growth.

- Fringe Loyalists (18%): Functionally active but emotionally shallow—easily swayed.

- Potential Loyalists (4%): Non-users with positive perceptions—prime for conversion.

- Others (58%): Either loyal elsewhere or indifferent, and costly to convert.

Blanket awareness campaigns are a dead end. Precision targeting, segment-specific communication, and differentiated offers are what drive conversion.

What Customers Actually Want

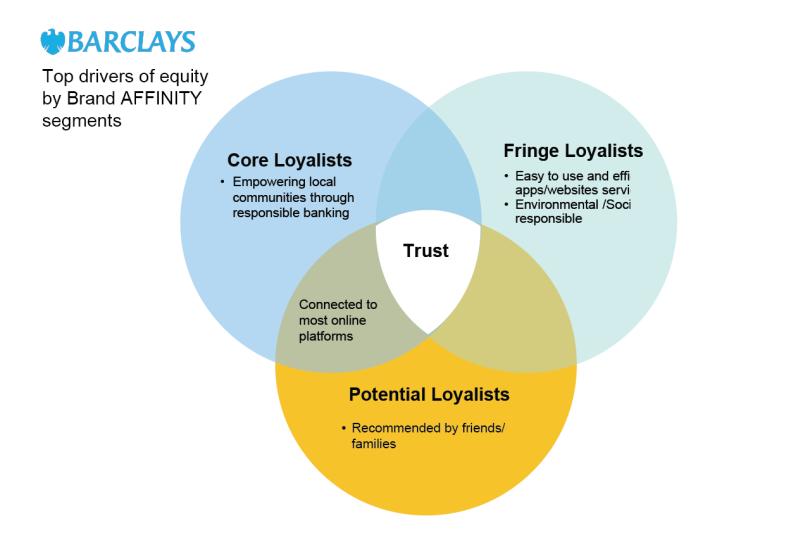

The study, based on brand-affinity relationship segmentation model, which serves as the foundation of Brand Kompass, underscores that loyalty is layered. Different groups have distinct priorities:

- Core Loyalists look for trust, community empowerment, and inspirational leadership.

- Fringe Loyalists prioritize seamless digital platforms, fraud protection, and visible social responsibility.

- Potential Loyalists expect modern onboarding, user experience excellence, and proof of purpose.

The implication? Banks must segment not by demographics, but by emotional proximity.

Trust Demands Emotional Connection

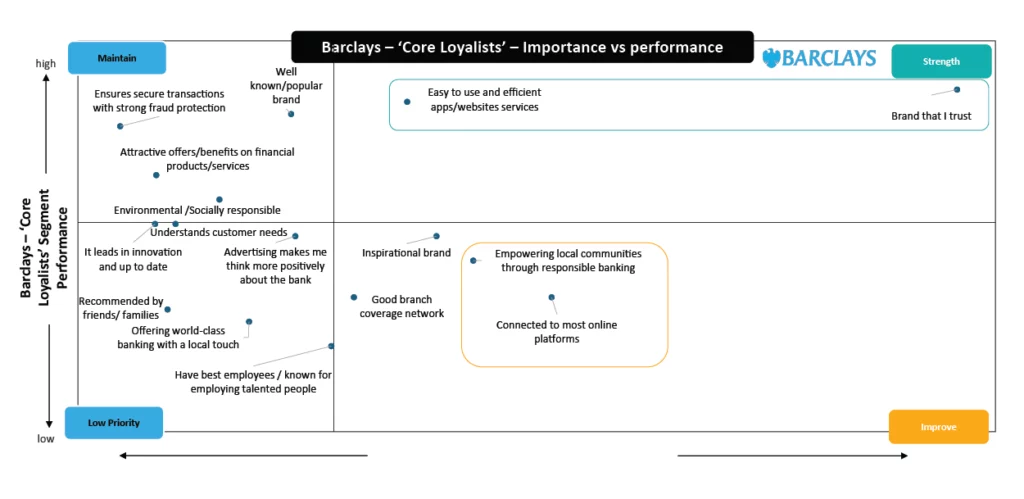

Consider Barclays again. The bank enjoys strong trust and solid digital capabilities, but its emotional resonance is lacking. Consumers view it as safe, but not loved. In a market increasingly driven by emotional markers like inspiration, advocacy, and recommendation, this is a vulnerability.

For Nationwide, the story is similar. While loyalists value its customer-first positioning, they now expect more—proof of environmental commitment, responsive digital touchpoints, and alignment with their cultural values. Nationwide’s challenge is to evolve from functional convenience to cultural connection.

The common thread? Operational strength is table stakes; emotional engagement is the differentiator.

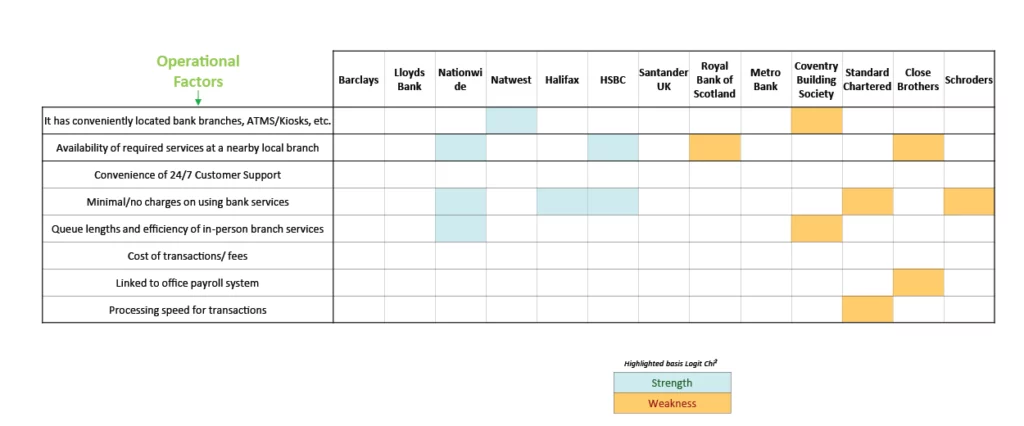

Operational Excellence as the Driver of Brand Equity

The brand tracking study highlights that consumers reward banks that deliver consistently on the basics:

- 24/7 customer support

- Fast, transparent transaction processing

- Accessible branches with minimal fees

What was once considered operational hygiene is now brand capital. If infrastructure and service delivery fail to match brand promises, credibility collapses. In this sense, execution is inseparable from positioning.

Relevance, Not Reach is the Need of the Hour

A striking finding is that awareness isn’t the problem. According to our brand awareness tracker, Fringe and Potential Loyalists know the big brands, but don’t feel emotionally aligned with them.

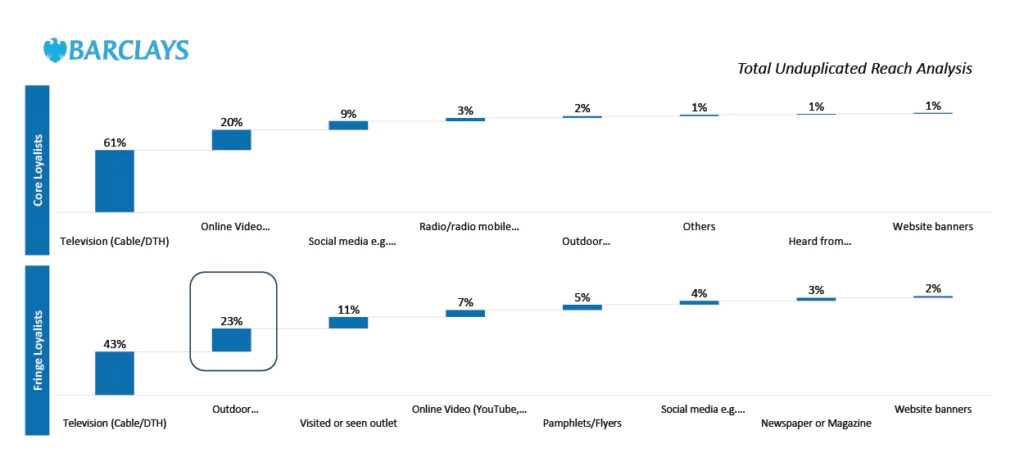

To break through, banks need to match media to motivation:

- Core Loyalists: Reward and inspire through loyalty platforms, email, and TV.

- Fringe Loyalists: Reassure and validate via OOH, social, and digital ads that highlight social responsibility.

- Potential Loyalists: Win them with mobile-first, influencer-led, and modern onboarding experiences.

The message is clear: relevance trumps frequency.

The Final Word: Building Stronger Customer Relationships

The next growth frontier in UK retail banking will not be about having the slickest mobile app or the lowest fees. It will be about cultivating emotional bonds, purposeful positioning, and flawless execution.

The study conducted using Borderless Access’ brand health tracker makes one thing clear: loyalty is the most defensible asset banks have. But it must be treated as a deliberate outcome of strategy—not a byproduct.

The real risk isn’t disruption from fintechs or mega-brands. It’s customer indifference.

For CXOs, the challenge is to answer three questions:

- How many of your users are truly loyal?

- Where are your loyalty leaks?

- How will you convert emotional proximity into business growth?

Banks that can answer these with conviction will own the future of retail banking.

Want to identify your most convertible segments, strengthen trust, and unlock sustainable growth using our innovative brand tracking tool?