Far more than a digital upgrade, the retail banking sector in Saudi Arabia is undergoing a seismic shift. Driven by the ambitious Vision 2030, a young, tech-savvy population is demanding hyper-personalized, mobile-first banking experiences, fueling the rise of super apps and digital-only neo banks like STC Pay and D360.

Banks are increasingly leveraging AI and gamification to personalize services, boost engagement, and genuinely support financial wellness. But with all this innovation comes responsibility. With AI ethics at the front and center now, novel regulations like the Saudi Personal Data Protection Law are setting new ground rules.

Then there is also a steady growth in mortgage lending, buoyed by favorable demographics and financial reforms, all perfectly aligned with the country’s broader economic goals. So, what does this mean for the future of retail banking and the broader economy in Saudi Arabia?

The latest study by Borderless Access powered by BrandKompass™, its proprietary brand tracking tool decodes how brand equity, emotional connection, and operational efficiency are emerging as the true engines of growth. Here’s what business leaders need to understand—and act on.

- Research Overview

- Identifying the Primary Growth Areas

- Every Segment Wants Something Different

- Why Brand Equity Alone Won’t be Enough Anymore

- Bridging The Advocacy Gap

- Loyalty Also Depends on the Range of Products Used by Customers

- Move Beyond Generic Engagement Strategies

- Grow Your Loyal Customer Base with Comprehensive Brand Tracking

Research Overview

This study was conducted by Borderless Access using its proprietary BrandKompass™ framework—a next-gen brand health tracker for measuring brand equity and affinity engineered to go beyond traditional awareness metrics and surface-level usage data.

Objective:

To decode how brand equity, emotional connection, and operational performance impact consumer behavior and loyalty in Saudi Arabia’s retail banking sector.

Target Group:

- Adults aged 18 years and above

- Active banking customers with individual or joint accounts (6+ months)

- Had conducted banking transactions, online activity, or service interactions in the last 3 months

- Were primary or joint decision-makers in household banking choices.

Segmenting Loyalty

Every bank has customers. But not every bank has advocates. BrandKompass maps consumer-brand relationships into high-impact cohorts:

| Segment | Who They Are | What They Need |

| Core Loyalists | Frequent users with high affinity | Inspiration, talent, exclusive offers |

| Fringe Loyalists | Infrequent users with weak bond | Trust, advocacy, assurance |

| Potential Loyalists | Non-users with emotional alignment | Visibility, social proof, frictionless onboarding |

| Open/Unavailable | Uncommitted or loyal to others | Clear differentiation, multi-channel storytelling |

Identifying the Primary Growth Areas

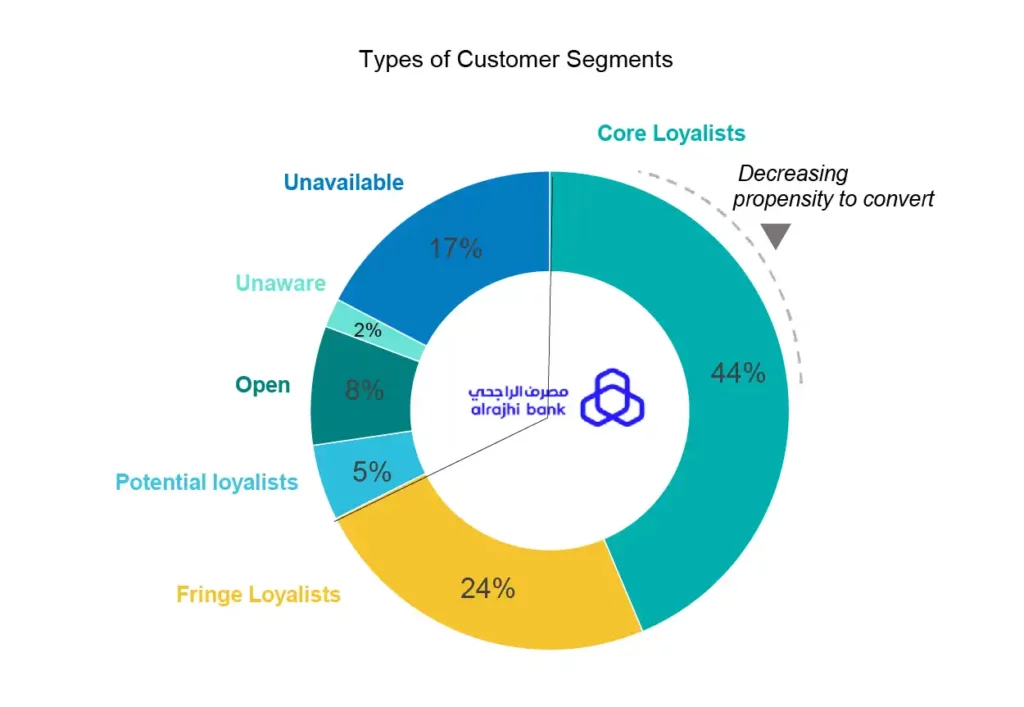

Using BrandKompass™, our proprietary brand tracking framework, we have segmented customers of Al Rajhi, one of KSA’s largest banks to identify their high-potential customer base.

Our study revealed that 68% of the customers seek Al Rajhi’s services in some way. But only 44% are emotionally committed. That delta—24% Fringe—is where the brand is vulnerable and where its next wave of growth lies.

Key Takeaway for CXOs: The best growth isn’t from converting strangers. It’s from converting believers who haven’t bought in fully yet.

Every Segment Wants Something Different

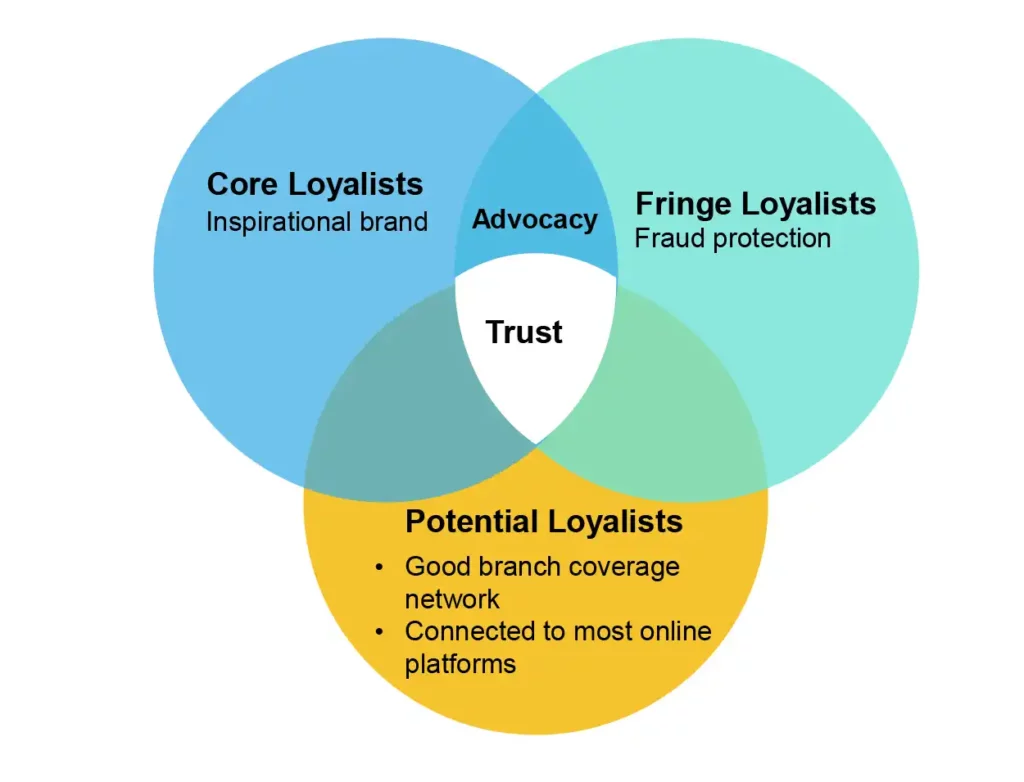

The research unpacks what truly matters to each customer segment:

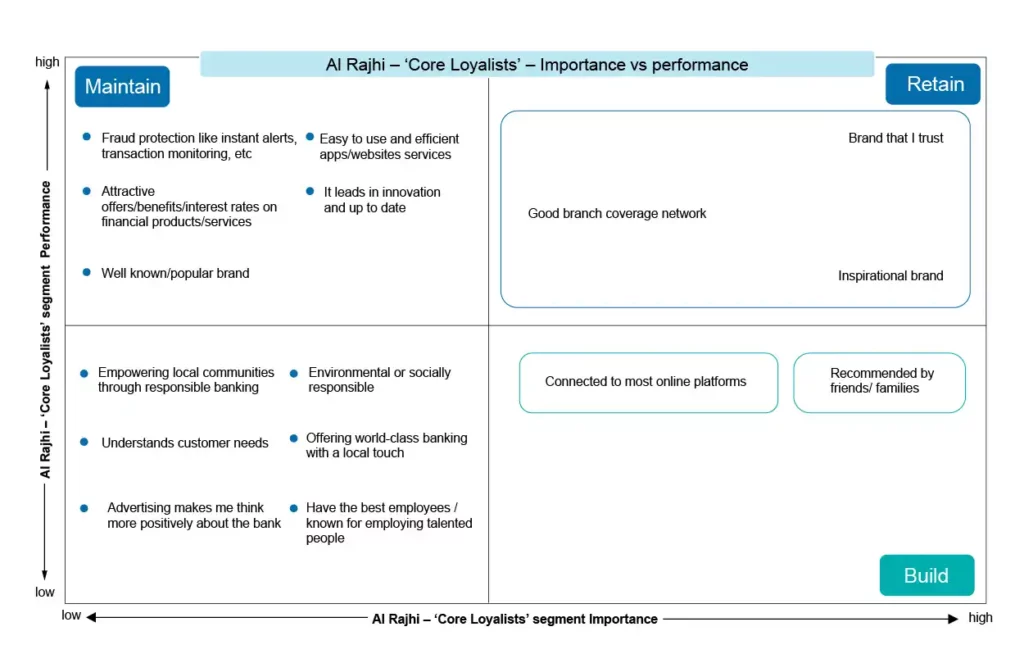

Core Loyalists crave:

- Brand inspiration

- Humanized service

- Purpose and leadership

Fringe Loyalists seek:

- Fraud protection

- Simple, secure services

- Peer validation

Potential Loyalists expect:

- Seamless onboarding

- Modern UX

- Values alignment

And yet, most banks continue to market with generic promises around security, service, and savings—ignoring the emotional triggers that deepen engagement.

Key Takeway for CXOs: Map your product and messaging strategy to loyalty stages, not just demographics.

Why Brand Equity Alone Won’t be Enough Anymore

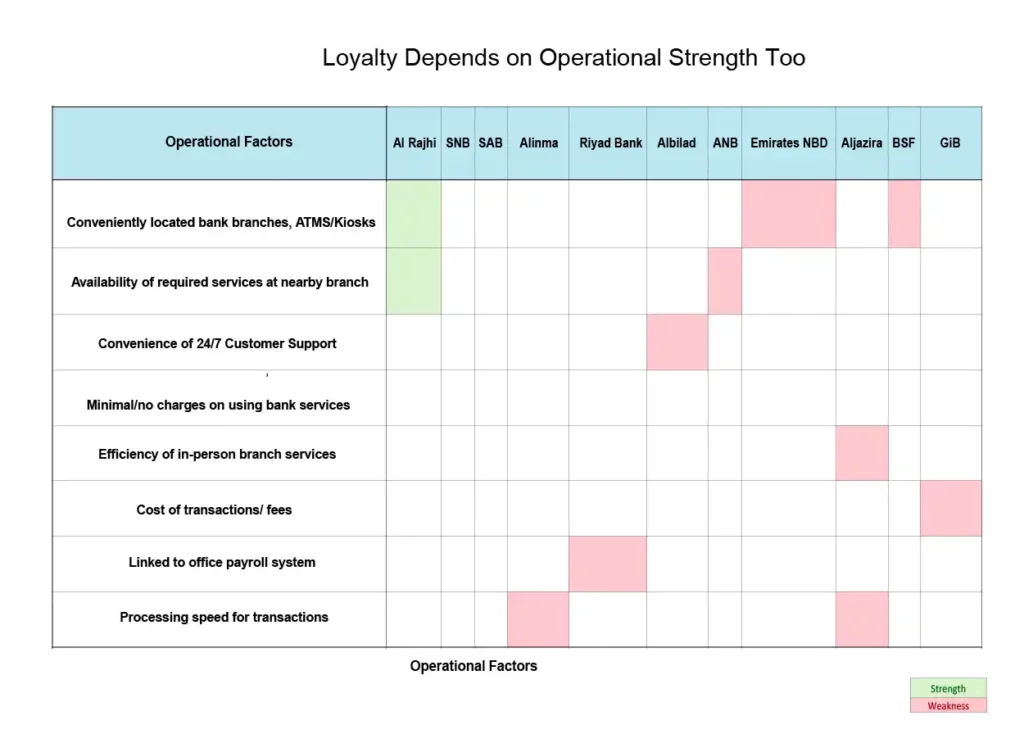

Many banks in KSA score well on brand trust and recall—but still lag in customer share. Why? Because brand equity isn’t translating into operational experience.

What the study reveals:

- Customers stay where 24/7 support, branch accessibility, and low transaction fees are not just promised but delivered.

- Al Rajhi, SAB, and SNB outperform not just in brand metrics—but in operational reality.

- Banks like Riyad and Albilad, while visible, must close the trust gap with better employee experience and seamless service delivery.

Key Takeaway for CXOs: Loyalty depends a lot on operational efficiency.

Bridging The Advocacy Gap

Our study highlights a rising trend in the retail banking sector—customers can be safe with you but not inspired by you, which signals a gap in advocacy and emotional storytelling.

According to our brand awareness tracker, Al Rajhi’s performance among Core Loyalists is strong—but cracks appear when you zoom in:

- High scores on trustworthiness and fraud protection

- Low scores on recommendation and inspirational brand identity.

If you are trusted and not loved, it can stunt organic advocacy and emotional stickiness, something critical in the retail banking sector.

Key Takeaway for CXOs: A bank’s core loyalist customer base should recommend its services to maintain and expand its share of loyal customers.

Loyalty Also Depends on the Range of Products Used by Customers

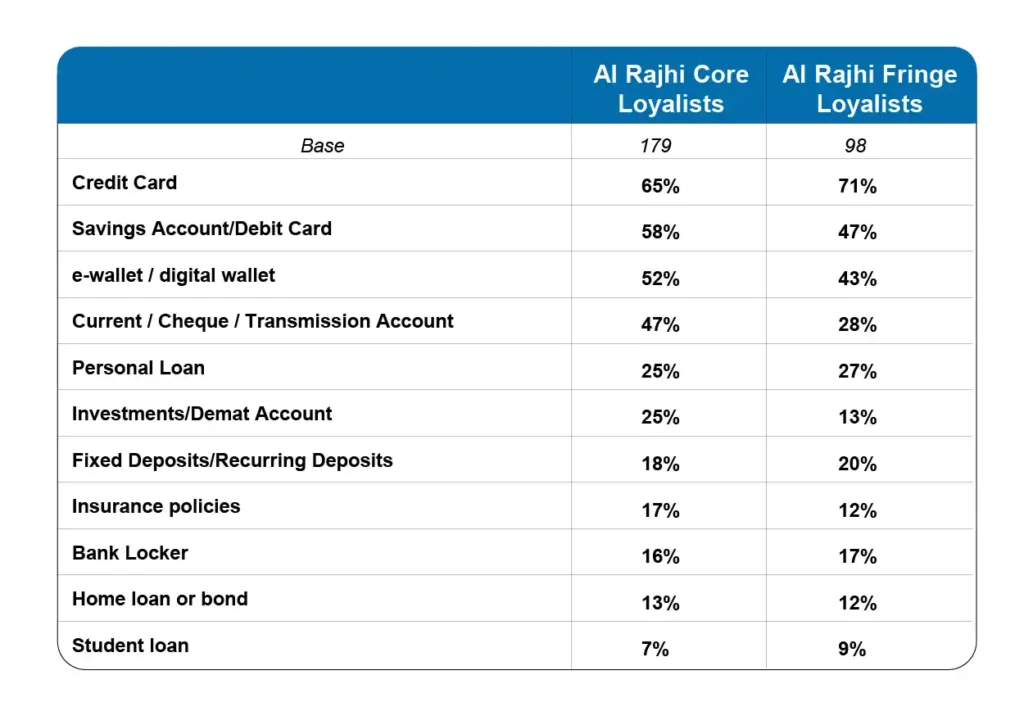

A deeper dive into Al Rajhi’s Core Loyalists reveal they engage across a wider range of products—credit cards, investment accounts, digital wallets—whereas Fringe Loyalists often have only a single relationship (e.g., credit card).

This matters because multi-product users churn less and refer more.

Key Takeaways for CXOs: Use behavioral segmentation to drive cross-sell strategy—but only after emotional trust is earned.

Move Beyond Generic Engagement Strategies

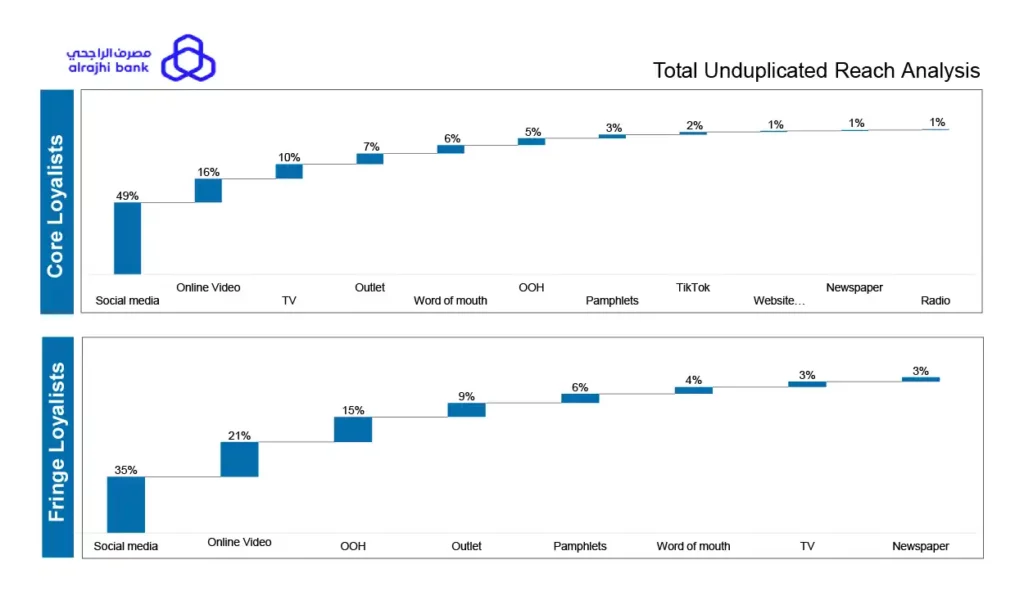

The notion that a single message or channel can effectively reach everyone is simply outdated in nearly every industry today. It’s time the retail banking industry took note of this fact. True engagement demands a more nuanced approach, one that recognizes the distinct characteristics and preferences of different customer segments.

Core Loyalists

- Best reached via digital platforms and personalized campaigns.

- Respond to emotionally intelligent content and brand-led storytelling.

Fringe Loyalists

- Need visibility through social media, OOH, and reputation-building.

- Trust friends and family more than ads.

Potential Loyalists

- Are younger, digitally fluent, and expect a frictionless path to onboarding.

- Use peer reviews, influencer content, and platform integration to evaluate options.

Key Takeaways for CXOs: Build media plans that mirror mindset, not just media consumption.

Grow Your Loyal Customer Base with Comprehensive Brand Tracking

In a country where 70% of the population is under 35, where digital is default, and where every brand promises security and convenience—emotional affinity is the last real differentiator.

This study shows that loyalty is measurable, segmentable, and absolutely actionable. The future of banking isn’t digital-first or branch-first. It’s customer-first—and context-led. The banks that act now will own the future of retail banking in KSA.