It’s no secret that today’s consumers aren’t just interested in what a brand sells. In fact, they care deeply about what a brand means. Today, with the constantly changing customer behaviors and their complex buying journeys, understanding the true value of your brand is more important than brand awareness. This makes brand equity a dynamic, evolving asset that fuels and depicts real business growth.

Brand equity tracking is essential for understanding how a brand truly connects with consumers, and the emotional value it holds in their minds. This value stems from key drivers such as trust in the brand’s promises, relevance to people’s needs and values, willingness to advocate for it, and loyalty in choosing the brand over its competitors.

While these concepts are hard to measure individually, a comprehensive brand tracking approach gives a clearer, and more accurate picture of a brand’s strength and growth potential.

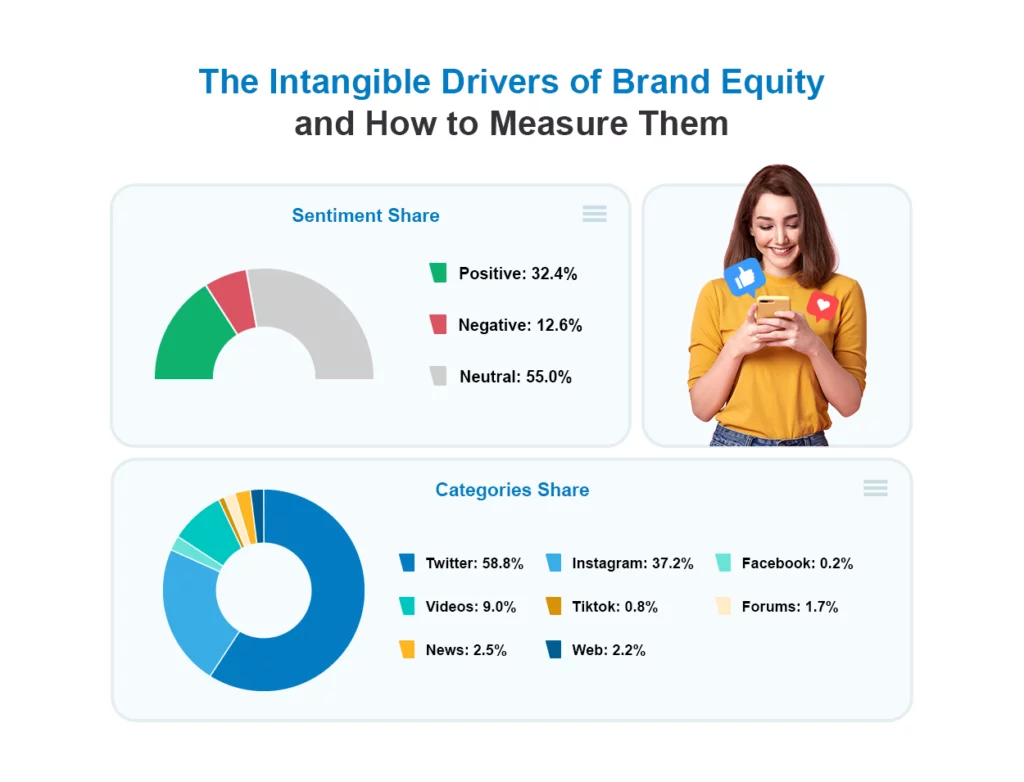

The Intangible Drivers of Brand Equity and How to Measure Them

Trust, relevance, advocacy, and loyalty; all these emotional factors lie at the core of brand equity. They influence consumer decisions far beyond the initial awareness tracked by most brand tracking programs. Focusing on brand equity is crucial when markets are crowded, consumer expectations are changing, or competitors are repositioning.

However, risks emerge when measurement strategies become misaligned. Focusing only on brand awareness tracking might boost traffic initially but fails to create meaningful engagement or repeat business. This misalignment often leads to spending on campaigns that increase visibility but don’t build preference, missing why customers aren’t converting or staying loyal, and overlooking weakening brand values or relevance.

This is where continuous brand tracking, combined with emotional and behavioral insights, becomes invaluable. It not only shows how your brand is perceived today but also uncovers early signals of shifting sentiment, loyalty erosion, or emerging opportunities.

Acting on these insights, businesses can strengthen brand resilience, make sharper strategic decisions, and unlock long-term growth well beyond basic awareness metrics.

How Borderless Access is Helping Brands Measure and Grow Their Brand Equity

Most traditional brand tracking tools focus on surface-level stats that do not reveal why consumers choose one brand over another. What they miss are the emotional drivers, such as trust, relevance, and advocacy, that truly define brand equity.

Borderless Access changes this with its proprietary brand diagnostic tool. It integrates both rational drivers, such as awareness and recognition, and emotional drivers, such as trust, relevance, and loyalty, creating a holistic, 360-degree view of brand health and providing brands a clear roadmap for action.

- Identify and Segment the Right Consumers: Using the Brand Affinity-Relationship Model, the solution segments consumers into loyalty-based groups, such as Core Loyalists, Fringe Loyalists, and Potential Loyalists, to reveal who is most likely to convert and stay loyal.

- Diagnose and Optimize Growth Drivers: It pinpoints the factors that move the needle, including equity, promotions, and operational drivers, so brands can act where it matters most.

- Precision Targeting for Maximum ROI: By mapping geolocation, media habits, and retail behavior of high-affinity consumers, it helps brands execute highly targeted campaigns that cut waste and improve ROI.

- Monitor and Continuously Improve: With longitudinal tracking and real-time insights, the solution ensures agility in responding to market shifts and evolving consumer sentiment.

More importantly, the brand tracking solution helps brands go beyond knowing who is aware of them, who truly values their brand and why.

A leading personal care brand in the mid-premium skincare category, had maintained steady awareness but was struggling to translate it into stronger loyalty and repeat purchase. While traditional brand tracking metrics showed healthy top-of-mind recall, it failed to explain why conversion rates and long-term engagement were stagnating, especially among younger, urban consumers.

The brand then partnered with Borderless Access to implement Brand Kompass, leveraging its Brand Affinity–Relationship Segmentation Model, to identify where the brand was losing emotional connection and how to convert high-interest consumers into loyalists.

Brand Kompass segmented the brand’s consumers into six distinct groups — from Core Loyalists to Passive Users. Analysis revealed that “Potential Loyalists” (22% of the customer base) had strong emotional connection but weak purchase frequency, a prime group for conversion. Using multi-layered metrics — awareness, usage, loyalty, and communication resonance — the tool identified two key barriers:

- Messaging misalignment: Campaigns emphasized product features rather than the emotional self-care narrative consumers sought.

- Channel inefficiency: High-affinity consumers were over-indexed on digital discovery but under-targeted in campaigns.

The insights provided by Brand Kompass guided the brand to reframe messaging around empowerment and self-confidence. The tool also helped the brand redirect 35% of digital spend towards high-affinity micro-segments and activate loyalty-driven offers to move all “Potential Loyalists” into the “Core Loyalist” category.

The results spoke for themselves, with an 18% increase in repeat purchase rate among 18–34-year-olds and 25% uplift in digital campaign ROI through refined targeting, along with a two-fold growth in the “Core Loyalist” segment.

Looking Ahead: The Future of Brand Measurement

As markets grow increasingly complex, the strategic use of brand tracking becomes a powerful competitive advantage. Real-time brand tracking data enables brands to better anticipate market shifts and stay deeply connected to evolving customer sentiments.

Holistic brand tracking solutions can lead this transformation, providing continuous insights to adapt marketing strategies swiftly and help brands deepen relationships, drive loyalty, and stay relevant in a constantly evolving marketplace.

FAQs

1. How is brand tracking different from market research?

Market research is often project-based and focused on a moment in time. Brand tracking, on the other hand, is ongoing ; like a heartbeat monitor for your brand.

2. How do brand lift studies differ from brand health tracking?

Brand lift studies assess short-term changes in awareness or perception after marketing campaigns, while brand health tracking evaluates ongoing brand equity and relationship metrics.

3. Why is brand equity measurement critical?

It reveals the emotional and loyalty factors that sustain a brand beyond simple recognition, informing strategic growth and positioning.

4. When should I use a brand awareness survey?

Use it to validate campaign reach, product launches, or new market entry where immediate visibility matters.